Amount Distribution with Suppliers

Describes how much the suppliers, the vendor, and MyFatoorah take from the invoice.

Introduction

In this section, we will illustrate how the amounts are distributed between the vendor and the suppliers added to the request. This will allow you to determine precisely your share of the invoice and how much each supplier will take.

Types of amount distribution

There are two ways of distributing the amount between you and the suppliers:

- Commission Value & Commission Percentage (If you have a fixed value, percentage, or both, use this as described below)

- Proposed Deposit Share (If the amount deducted varies from one case to another, use this as described below)

Commission Value & Commission Percentage

Commission Value: The amount that the vendor will take as a commission regardless of the value of the invoice.

Commission Percentage: The percentage of the amount that the vendor will take from the value of the invoice.

Kindly notice that you can choose both of them, one of them, or neither of them (Set the unwanted parameter to 0)

These amounts are determined during the creation of the supplier and can be edited again later either by using the APIs or from your MyFatoorah dashboard. CreateSupplier & EditSupplier

Percentage from Net ValueYou can choose your percentage to be calculated from the net value of the invoice instead of the total value of the invoice.

Net Value = Total Value - MyFatoorah Commissions - VAT Value

This feature is available if and only if there is one supplier in the invoice.

In case there is more than one supplier in the invoice and the feature is activated, the commission percentage of the vendor will be calculated from the total value of the invoice.

Custom Commission for Payment Method

You have the flexibility to establish customized commission values and commission percentages for suppliers, tailored to the specific payment methods employed for transactions. If a customized commission has been configured for a specific payment method, and this payment method is utilized for the transaction, MyFatoorah will apply the specified customized commissions accordingly.

Default CommissionsIn cases where the employed payment method is not included in the customized commission settings for the supplier, MyFatoorah will resort to utilizing the default commission value and percentage assigned to that particular supplier.

Proposed Deposit Share

Proposed Deposit Share is a parameter that you enter in the Suppliers parameter array in your request to MyFatoorah.

The amount that you enter in the ProposedShare is the amount that the supplier will get and the rest of the amount will be transferred to the vendor.

Calculation of Vendor CommissionIf the ProposedShare parameter is entered, it will overwrite the Commission Value & Commission Percentage.

If the ProposedShare parameter is not entered or entered as null, the commission of the vendor will be calculated based on the Commission Value & Commission Percentage.

MyFatoorah Commission Calculation

In this section, we are going to clarify how MyFatoorah commission is calculated then we will demonstrate this by using examples.

MyFatoorah CommissionFor the sake of the discussion, MyFatoorah commission = Transaction Fees + VAT value.

1. Proposed Deposit Share = null, One supplier:

- MyFatoorah commission will be deducted from the invoice value.

Net Invoice Value = Invoice Value - MyFatoorah Commission - Vendor commission will be deducted.

Vendor Commission = Commission Value + Commission Percentage x Invoice Value - The supplier receives the remaining amount.

Supplier Deposit Share = New invoice Value - Vendor Commission

Example1:

Invoice Value = 100, Commission value = 0.5, Commission percentage = 2%,

MyFatoorah commission value = 1, MyFatoorah commission percentage= 1%, VAT = 5%,

Percentage from net value: false

Deducting MyFatoorah commission:

Net Invoice Value = 100 - (1 + 0.01 x 100 + 0.05 x 100) = 93

Vendor commission:

Vendor Commission = 0.5 + 0.02 x 100 = 2.5

Supplier deposit share:

Supplier Deposit Share = 100 - (1 + 0.01 x 100 + 0.05 x 100) - (0.5 + 0.02 x 100) = 90.5

Example2:

Invoice Value = 100, Commission value = 0.5, Commission percentage = 2%,

MyFatoorah commission value = 1, MyFatoorah commission percentage= 1%, VAT = 5%,

Percentage from net value: true

Deducting MyFatoorah commission:

Net Invoice Value = 100 - (1 + 0.01 x 100 + 0.05 x 100) = 93

Vendor commission:

Vendor commission = 0.5 + 0.02 x 93 = 2.36

Supplier deposit share:

Supplier Deposit Share = 100 - (1 + 0.01 x 100 + 0.05 x 100) - (0.5 + 0.02 x 93) = 90.64

2. Proposed Deposit Share = null, Multiple suppliers:

-

MyFatoorah commission will be deducted from each supplier in the same percentage of their invoice shares of the total invoice value respectively.

For example : Supplier 1 invoice share = 100, Supplier 2 invoice share = 200,

MyFatoorah Commission = 6

Deduction from Supplier 1 = 2, Deduction from Supplier 2 = 4

Please notice that for supplier 1: Invoice Share Percentage = Deduction Percentage = 33.33%

Supplier 2: Invoice Share Percentage = Deduction Percentage = 66.66%

Supplier Amount = Invoice share - MyFatoorah commission from each supplier -

The vendor takes his commission from each supplier based on the Commission Percentage & Commission Value of each one

Supplier Deposit Share = Supplier amount - Vendor Commission

Example3:

Invoice Value = 100, Supplier 1: Commission value = 0.5, Commission percentage = 2%, Invoice Share = 40

Supplier 2: Commission value = 0.8, Commission percentage = 5%, Invoice Share = 60

MyFatoorah Commission = 12.65

Deducting MyFatoorah Commission:

Supplier1 MyFatoorah Commission = 40 - (12.65 x 2 / 5) = 34.94

Supplier2 MyFatoorah Commission = 60 - (12.65 x 3 / 5) = 52.41

Vendor Commission:

Supplier1 = 0.5 + 0.02 x 40 = 1.3

Supplier2 = 0.8 + 0.05 x 60 = 3.8

Deducting Vendor Commission:

Supplier1 Deposit Share = 40 - (12.65 x 2 / 5) - (0.5 + 0.02 x 40) = 33.64

Supplier2 Deposit Share = 60 - (12.65 x 3 / 5) - (0.8 + 0.05 x 60) = 48.61

3. Proposed Deposit Share = value, Single Supplier

- The supplier receives the amount entered in the ProposedShare parameter.

- The vendor receives the remaining part of the amount.

- MyFatoorah commission is deducted from the vendor.

Example3:

Invoice Value = 100, Proposed Deposit Share = 95, MyFatoorah Commission = 4

Vendor Deposit share = 100 - 95 - 4 = 1

Supplier Deposit Share = 95

4. Proposed Deposit Share = value, Multiple Suppliers

Same steps as a single supplier. So, we will give an example:

Example4:

Invoice Value = 100,

Supplier1: Invoice Share = 40, Proposed Deposit Share = 35

Supplier2: Invoice Share = 60, Proposed Deposit Share = 55

MyFatoorah Commission = 5

Vendor Deposit Share = 100 - 55 - 35 - 5 = 5

Supplier1 Deposit Share = 35

Supplier2 Deposit Share = 55

MyFatoorah CommissionIf the vendor doesn't have enough balance in the invoice for MyFatoorah commission, the rest of the amount is taken from the last supplier entered in the request.

MyFatoorah Calculations of Suppliers Amount

There are two ways to find out how much money was received by the suppliers, the vendor, and MyFatoorah for each order.

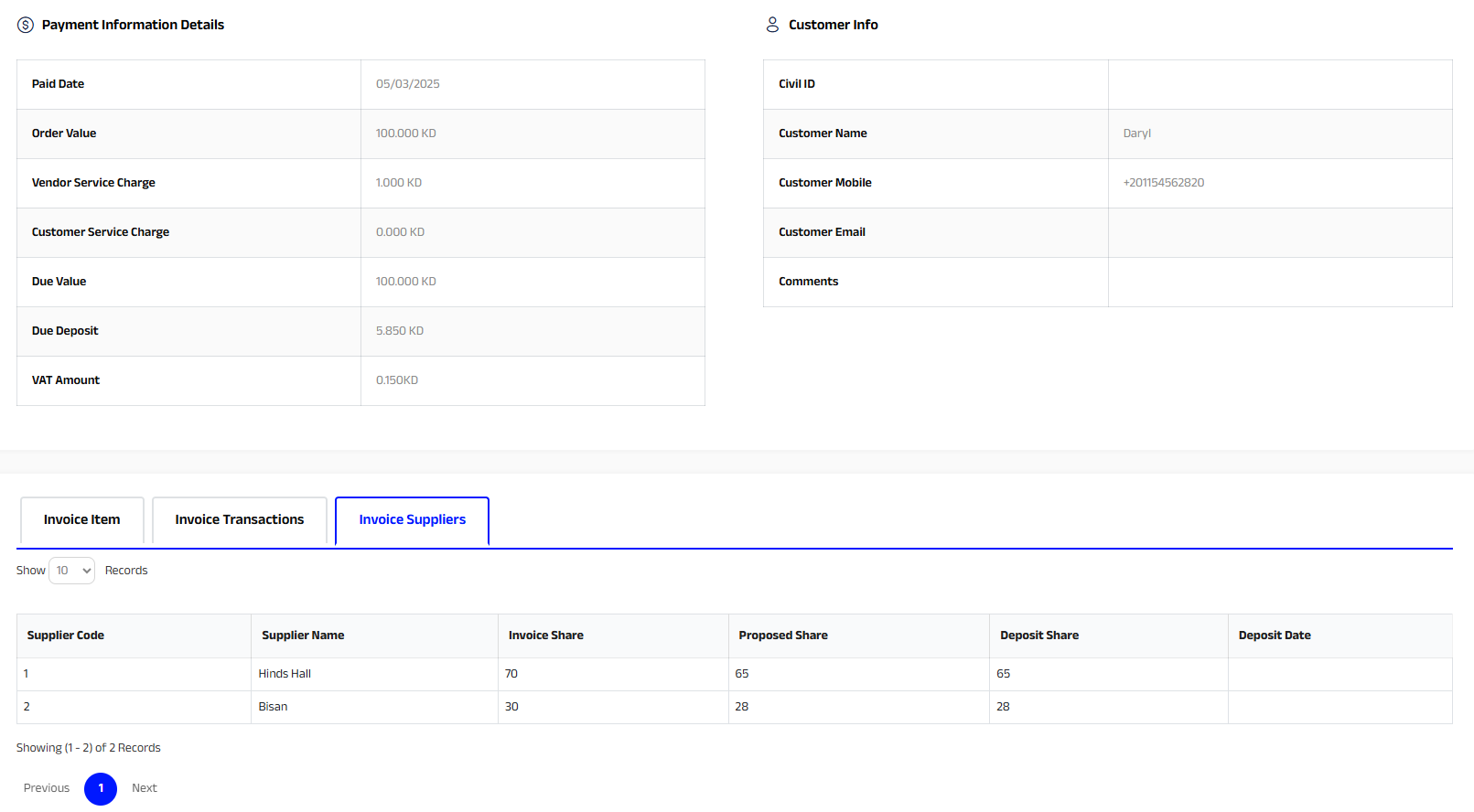

Orders List from MyFatoorah Portal

GetPaymentStatus Endpoint

1. Orders List

- Go to Orders List in MyFatoorah portal.

- Open the order that you want to check the amounts of.

- At the bottom of the page, click on Invoice Suppliers

- The vendor share is: Due Deposit

- MyFatoorah commission is: Vendor Service Charge + VAT amount

- Each supplier share is: Deposit Share for each supplier

2. GET Payments

- Send the order that you want to check in the Request to MyFatoorah.

- In the response, you will find the amount that each supplier took in the suppliers parameter.

- Check below for example:

{

"IsSuccess": true,

"Message": "",

"ValidationErrors": null,

"Data": {

"Invoice": {

"Id": "6389760",

"Status": "PAID",

"Reference": "2025060933",

"CreationDate": "2025-12-24T17:41:37.7200000Z",

"ExpirationDate": "2026-06-22T17:41:37.7200000Z",

"ExternalIdentifier": null,

"UserDefinedField": "",

"MetaData": null

},

"Transaction": {

"Id": "105741",

"Status": "SUCCESS",

"PaymentMethod": "VISA/MASTER",

"PaymentId": "07076389760322480573",

"ReferenceId": "535817105741",

"TrackId": "24-12-2025_3224805",

"AuthorizationId": "105741",

"TransactionDate": "2025-12-24T17:41:55.0700000Z",

"ECI": "02",

"IP": {

"Address": "41.35.105.183",

"Country": "Egypt"

},

"Error": {

"Code": "",

"Message": ""

},

"Card": {

"NameOnCard": "Ahmed",

"Number": "512345xxxxxx0008",

"Token": "",

"PanHash": "b888aa5f23a817883d4d12c74044bab1ae6ee65dc8d6e11515394aba452b273b",

"ExpiryMonth": "12",

"ExpiryYear": "39",

"Brand": "Mastercard",

"Issuer": "Test Bank",

"IssuerCountry": "KWT",

"FundingMethod": "credit"

}

},

"Customer": {

"Reference": "",

"Name": "Anonymous",

"Mobile": "+965",

"Email": ""

},

"Amount": {

"BaseCurrency": "KWD",

"ValueInBaseCurrency": "20",

"ServiceCharge": "0.4",

"ServiceChargeVAT": "0.06",

"ReceivableAmount": "4.54",

"DisplayCurrency": "KWD",

"ValueInDisplayCurrency": "20",

"PayCurrency": "KWD",

"ValueInPayCurrency": "20"

},

"Suppliers": [

{

"Code": 1,

"Name": "sss",

"InvoiceShare": "10",

"ProposedShare": "7",

"DepositShare": "7"

},

{

"Code": 2,

"Name": "Bisan",

"InvoiceShare": "10",

"ProposedShare": "8",

"DepositShare": "8"

}

]

}

}3. Webhook

{

"Event": {

"Code": 1,

"Name": "PAYMENT_STATUS_CHANGED",

"CountryIsoCode": "KWT",

"CreationDate": "2025-12-24T17:44:22.0570000Z",

"Reference": "WH-615417"

},

"Data": {

"Invoice": {

"Id": "6389761",

"Status": "PAID",

"Reference": "2025060934",

"CreationDate": "2025-12-24T17:44:10.2Z",

"ExpirationDate": "2026-06-22T17:44:10.2Z",

"UserDefinedField": "",

"ExternalIdentifier": null,

"MetaData": null

},

"Transaction": {

"Id": "106821",

"Status": "SUCCESS",

"PaymentMethod": "VISA/MASTER",

"PaymentId": "07076389761322480673",

"ReferenceId": "535817106821",

"TrackId": "24-12-2025_3224806",

"AuthorizationId": "106821",

"TransactionDate": "2025-12-24T17:44:22.0078323Z",

"ECI": "02",

"IP": {

"Address": "41.35.105.183",

"Country": "Egypt"

},

"Error": {

"Code": "",

"Message": ""

},

"Card": {

"NameOnCard": "Khaled",

"Number": "512345xxxxxx0008",

"Token": "",

"PanHash": "b888aa5f23a817883d4d12c74044bab1ae6ee65dc8d6e11515394aba452b273b",

"ExpiryMonth": "12",

"ExpiryYear": "39",

"Brand": "Mastercard",

"Issuer": "Test Bank",

"IssuerCountry": "KWT",

"FundingMethod": "credit"

}

},

"Customer": {

"Name": "Anonymous",

"Mobile": "+965",

"Email": ""

},

"Amount": {

"BaseCurrency": "KWD",

"ValueInBaseCurrency": "20",

"ServiceCharge": "0.4",

"ServiceChargeVAT": "0.06",

"ReceivableAmount": "4.54",

"DisplayCurrency": "KWD",

"ValueInDisplayCurrency": "20",

"PayCurrency": "KWD",

"ValueInPayCurrency": "20"

},

"Suppliers": [

{

"Code": 1,

"Name": "sss",

"InvoiceShare": "10",

"ProposedShare": "7",

"DepositShare": "7"

},

{

"Code": 2,

"Name": "Bisan",

"InvoiceShare": "10",

"ProposedShare": "8",

"DepositShare": "8"

}

]

}

}Updated 16 days ago